Before chemical industry 4.0, before Amazon, before Windows 97, before even the Internet, industrial chemical suppliers picked up the phone, wrote a letter, and sent a fax to offer their chemical products to prospective clients.

Later, as the wild, wild west of the world wide web took hold as the third millennium began, chemical industry supply chainers switched from ‘bricks’ to ‘clicks’ to gain their chemical trades. And so was born a plethora a start ups; Elemica, Omnexus, Rubber Network, Ariba, Covisinit, Quadrem, and Chemplorer hoping to find a business model to conquer online chemical trading.

While most focused on an order-to-cash or procure-to-pay process, some could be considered original online chemical marketplaces. Some ideas were badly executed, others had the right idea at the wrong time; none truly succeeded.

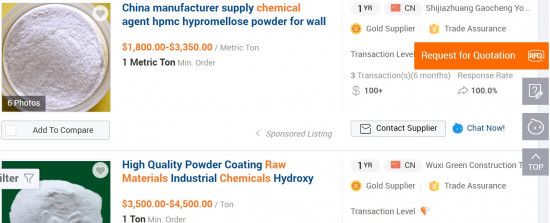

E-business in 2019 has matured, allowing for a series of different solutions that has seen a slower, more cautious spread of online chemical marketplaces. Their differences stemming from their different starting points.

As Simon Hardy, a chemical industry consultant at Elemica, notes, “In today’s business economy we see Chemical Companies taking various approaches to generating marketplace revenue. From the industry itself you have solutions built by the Chemical industry, which are Chemondis, OneTwoChem and Covestro Select. There is also a group that has either come from chemical distribution or saw a gap in the market and created a company to address it. These include companies like GoBuyChem and Pinpools. Agnostic platforms such as Alibaba and Amazon are also growing share in this marketplace. Recently, we have also seen interest from eBay, which already has a very successful B2B Marketplace operating for the Aviation Industry.”

Despite the action of the larger players, there remains a long list of online chemical trading spaces created as start-ups; Buyersguidechem, Lookchem, and Globalchemmade; all striving to make their presence known. Which ones will survive will depend on three main factors:

- Functionality. The smoothest webpage with the widest product choice.

- Investor staying power. For how long will the backers of these companies be prepared to take losses (in the hope of becoming the next Alibaba) before they pull the plug?

- The entry into the market of another big player. As Hardy mentioned, Alibaba, Amazon, and eBay have already made tentative expansions into industrial chemical sales. But what if Bayer, DowDuPont, or INEOS made a sizeable investment. Their know-how, market influence, and bank balance could be a game-changer.

Hopefully, the chemical industry is wise enough to avoid the B2C style campaigns of click-bait marketing, but no one can be certain that the market will not head in that direction.

Whilst chemical procurement officers are typically of above average intelligence, we are all still human and prone to the same basic marketing tools that sell ice cream and toothpaste. Most likely, the chemical industry will get the online market it deserves.

Instead, we can only hope that online markets that are more customer-centric will find success.

As Hardy notes, “Today’s buyers want to order in a B2C way, where they know where their order is at all times and when and where and what time it will be delivered.”

Having information at the touch of a tablet is the true benefit that online chemical marketplaces can offer. And while it may seem far-fetched for an industry with such long lead times and complex logistics to reach this goal; time and money can achieve great things.

Because, if, within the next decade, only 10% of the chemical industry’s annual $5 trillion revenue flowed through online marketplaces it would create a $500 billion sub-sector. Money like that could make a pretty smooth website and order tracker.

Photo credit: Freeimages