-

Biochemicals at a Crossroads as Cellulosic Ethanol Facility goes on Sale

Continue Reading

Continue ReadingThe future of the biochemical industry became less certain last month, when two of the industry’s major players, DuPont and Beta Renewables announced that they are ‘pulling back from agricultural waste to ethanol’ technology. This has led many chemical suppliers and raw material manufacturers to wonder if cellulosic ethanol production is economically viable.

The fact that DuPont is trying to sell its Nevada, Iowa facility will come as a shock to many, as DuPont has long been a supporter of the use of plant waste as a chemical feedstock. As the chemical industry journal C&EN notes, the company has already invested, “more than $200 million [in the Iowa plant], which was intended to be the first of a string of facilities that would use DuPont enzymes and yeast to turn corn cobs, stems, and leaves into ethanol.”

While DuPont has downplayed the news, stating in a press release that, “we still believe in the future of cellulosic biofuels,” the sale announcement came at the same time as news that Beta Renewables has become financially uncertain. This is because Mossi & Ghisolfi, the parent company of the Italian cellulosic biofuel manufacturer, has declared bankruptcy, leaving Beta Renewables’ ethanol production plans unclear.

Meanwhile, another cellulosic ethanol plant, this time in Hugoton, Kansas, was sold last year by bankrupted Abengoa. This is adding uncertainty over the viability of cellulosic ethanol production as the buyer, Synata Bio, plans to “convert the plant into a natural-gas-based chemicals and fuels facility.”

These developments clearly show that bioethanol is struggling to compete with traditional chemical producers, and has many wondering what path biochemicals will now take.

In May 2017, a study was published in the scientific review journal, Current Opinion in Biotechnology, which found that the current state of technology for bioethanol was not price competitive with fossil fuel alternatives. The analysis was conducted by a team from the University of California, the National Renewable Energy Laboratory, Argonne National Laboratory, & Thayer School of Engineering, entitled, Cellulosic Ethanol: Status and Innovation. It reviewed the current economic viability of technology, as well as studying scientific developments and their application to real-world industrial chemical production. The research concluded that, “Although the purchase price of cellulosic feedstocks is competitive with petroleum on an energy basis, the cost of lignocellulose conversion to ethanol using today’s technology is high.” The study goes on to report that, “Cost reductions need to be pursued via innovation, for example, consolidated bioprocessing using thermophilic bacteria combined with milling during fermentation (cotreatment).”

If this study is accurate, then ‘paradigm innovation’ is required to make bioethanol the normal chemical production route. The alternative is if public opinion towards fossil fuel use changes, and demand for cellulosic ethanol and similar biochemical raw materials grows.

At present, cheaper production of ethanol from fossil fuel is more popular, but opinion is changing. A recent survey by bioengineering firm Genomatica in cooperation with ICIS, found that “Producers report that 65% of their customers are interested in sustainably-produced chemicals. While 63% report a higher level of interest from their customers than three years ago.”

While the opinion of chemical buyers is adjusting to environmental concerns, technology is also lowering costs, making bioethanol an increasingly attractive option. As the environmental journal, Earth Island, reports, “[America’s] National Renewable Energy Laboratory (NREL) has been working on cellulosic ethanol since 1980. The tedious process of turning cellulose into biofuel involves breaking up the complex cellulose-hemicellulose-lignin structure before fermentation begins. A big part of the challenge for researchers has been finding enzymes to facilitate this process.”

The cost of these enzymes makes a significant difference at the marketplace, as the journal makes clear, “A decade ago, the enzymes to produce cellulosic ethanol cost $3 a gallon. [But now] NREL has reduced the cost to 30 cents, and is figuring out how to cut that amount in half by bioengineering more effective enzymes that will accelerate the process.” Adding that, “Over the past decade, NREL has brought down the cost of cellulosic ethanol from about $10 a gallon to $2.15 a gallon, primarily by bioengineering better enzymes.”

With costs falling and technology providing newer, more cost-effective enzymes every year, there is good reason for supporters of bioethanol to be hopeful. Even despite DuPont and Beta Renewables problems with greener industrial chemicals, Clariant is moving ahead with the construction of a cellulosic ethanol production plant in Romania. As the industry journal Chemicals-Technology reports, “With an annual capacity of 50,000t, the plant will use Clariant’s sunliquid technology to produce cellulosic ethanol from agricultural residues, including wheat straw and corn stover that will be sourced from local farmers.”

The success of this facility remains to be seen, but the history of companies attempting to break fossil fuels grip on chemicals production is not promising. As Forbes magazine reported last year, “the advanced biofuel sector has proved to be a good way for investors to lose money. KiOR (now renamed Inaeris Technologies) is probably the most famous publicly-traded example, going from an IPO that valued the company at $1.5 billion in 2011 to being bankrupt in 2014. Other companies that have competed in the advanced renewable hydrocarbon space have seen 90% or greater losses since their IPO (e.g., Solazyme, Gevo, Amyris).”

The report continues by giving the layman’s reason for such dismal results, stating that, “Advanced biofuels are attempting to compete with petroleum, but the reality is that with petroleum, nobody had to plant or harvest the biomass, and nobody had to apply the heat and pressure to convert it into an energy-dense liquid fuel. With biofuels, you have inputs of energy and manpower at every step — and the cost of those inputs adds up. That’s why petroleum made from ancient algae can be produced for a couple of dollars per gallon, but renewable petroleum produced from algae can be more than 10 times that cost. That’s why you don’t see many large-scale biofuel operations.”

And until key changes are made in this situation, biochemicals will never compete on price with petrochemicals.

Photo credit: Agrinet, HoosierAgToday, autoblog

-

Chemical Industry Failing to Meet Paris Climate Change Agreement Targets

Continue Reading

Continue ReadingA recently published report by CDP, a not-for-profit charity focusing on data for investors and chemical supply chain analysts, has found that the chemical industry is failing to meet Paris Climate Change Agreement targets. While the insightful report did suggest that some companies have made significant progress towards improved energy efficiency, sustainable feedstock sourcing, and lowering carbon emissions, on the whole progress was too slow and the changes that have been implemented do not go far enough.

How to Assess the Chemical Industry’s Environmental Impact

The report, entitled ‘Catalyst for Change’, assessed the top 22 largest chemical companies in the world in four key areas, thus aligning the study with recommendations from the G20 Financial Stability Board’s Task Force on Climate-related Financial Disclosures (TCFD). These areas were:

- Transition risks: Assessing companies’ emissions intensity, energy intensity and indirect global greenhouse gas (Scope 3) emissions in the value chain.

- Physical risks: Assessing companies’ use of water, water quality and governance metrics.

- Transition opportunities: Assessing companies’ progress and strategy in shifting towards a low carbon economy by looking at product and process innovation, low carbon revenues, R&D spend and use of renewable energy.

- Climate governance and strategy: Analyzing companies’ governance frameworks including emissions reduction targets and alignment of governance and remuneration structures with low carbon objectives.

Sustainability is a key area for the chemicals industry given that the environmental journal Sustainable Brands, notes that, “The chemical sector is responsible for an eighth of global industrial CO2 emissions and plays a key role in the world economy, with 95 percent of all manufactured products relying on chemicals. Despite the industry’s ability to innovate on low carbon, it will struggle to fully decarbonize if it doesn’t make rapid and significant changes to its own highly polluting processes.”

Making Progress but on Climate Change the Chemical Industry “Doesn’t go Far Enough”

This means that the CDP document is a significant school report on the progress that the industry is making. The results so far offer both encouraging and disappointing news. Its states that;

- “The chemicals sector performs well in terms of emissions and energy intensities, with most companies in the universe covered showing annualized improvements in emissions and energy efficiency of between 2-5% which flow directly to the bottom line.”

Adding that, “Efficiency improvements are likely to continue, although the pace will be incremental in the short term, evidenced by much less ambitious targets for emissions intensity, [in an industry where] even small changes in efficiency could be meaningful given the scale of operations.” - The report notes that there is a lack of strong impact innovation, with, “High carbon risks remaining for the sector in the medium to long term which require game changing technologies in feedstock and processes which are a good 5 -10 years away with current process innovation based on incremental improvements.”

- While the investment into R&D is present (notably five times higher than other industries), the industry lacks transparency, “evidenced by the lack of reporting on disaggregated data, with a prolonged period of cross border M&A and vertical integration creating groups which are hard to analyze and regulate.”

- Furthermore, the industry is likely to experience a ‘diesel’ moment, when political pressure to achieve a circular economy will impact the packaging and plastics industries. This pivotal event will be similar in scale to that affecting the automotive industry and how it has been rocked by legislation promoting lower emissions from diesel vehicles.

- The report also comments on the vast regional differences in legislation, with “European chemical companies facing tougher regulation from committed carbon emission cuts and potentially higher capex in the medium to long term.” Such differences were also noted for water consumption, which varied greatly from region to region and sector to sector.

- Finally, the report singled out AkzoNobel as a “clear leader, outperforming all other companies by a clear margin across most metrics.” While labelling Formosa and LyondellBasell as the worst ranking chemical companies in the study.

However, the report does have some major flaws, as critics (and the report itself) have pointed out that the analysis does not include, “Chinese chemical industry and the petrochemical businesses of oil & gas companies.” This is significant given that the Chinese chemical industry accounts for 40% of global chemical production, and the Chinese government’s failure to provide data for analysis harms efforts to combat climate change.

Similarly, by studying only the largest 22 chemical companies, the report is focusing on only 25% of the chemical industry’s total emissions. In fact, the report highlighted the challenges in regulating, studying, and governing such a large, varied, and fractious industry. Where law changes or processes implemented for one sector may be completely inappropriate and unworkable in another.

How Committed is the Chemical Industry to Combating Climate Change?

In response to the criticism provided in the report, the chemical industry has reaffirmed its environmental pledges. American Chemicals Society executive director and CEO Thomas Connelly Jr stating that, “Climate change represents a real and current threat to our economy, health and welfare. America should continue to take the lead in addressing global greenhouse gas emissions and become a leader in sustainable energy production and technology.”

The European chemical industry remains similarly committed, with that CEFIC already planning on ways that, “the chemical industry can become carbon neutral by 2050.” While CEFIC Director General Marco Mensink remains positive about the future, stating at a recent event, that, “The Emissions Trading Scheme (ETS) Innovation Fund should contribute to technology that can effectively decrease CO2 emissions.”

What Should the Chemical Industry be Doing for the Environment?

However, while the chemical industry as a whole has been quick to claim the moral high ground, by reaffirming its commitment to sustainability and to lowering carbon emissions, it has yet to put sufficient meat on the bones to answer some of the industry’s toughest questions.

• Can the chemical industry stop its reliance on fossil fuels?

• Can the industry self-regulate itself sufficiently to prevent cases of localised pollution (Baia Mare Cyanide spill, Bhopal, BP oil leak in the Gulf of Mexico, Tennessee fly ash slurry leak …)?

• Can the chemical industry innovate more environmentally sound and sustainable products, such as bioplastics, or sustainable, non-plastic packaging quick enough?

• Can the industry sufficiently lower its energy use, currently 11% of global total (28% of global industrial use)?As Paul Simpson, CEO of CDP, told the environmental journal The New Economy: “As both a large energy user itself and a crucial part of other industrial supply chains the chemicals industry is an important, but often overlooked, sector when it comes to environmental impact. Today’s analysis shows it’s moving in the right direction across several climate metrics with encouraging signs on annual emissions and R&D, but it needs to go further and faster to invest in the technologies that will deliver efficiency and emissions improvements. Ultimately it needs to set and achieve more ambitious environmental targets to reach a tipping point that both catalyzes progress towards the Paris Agreement goals and directly improves the bottom line.”

Photo credit: metrology blogspot, algorithima-technologies, & climatechangenews

-

Chemists Develop a Practical Toolbox for Predicting the Solubility of Small Molecules in Different Solvents

Continue Reading

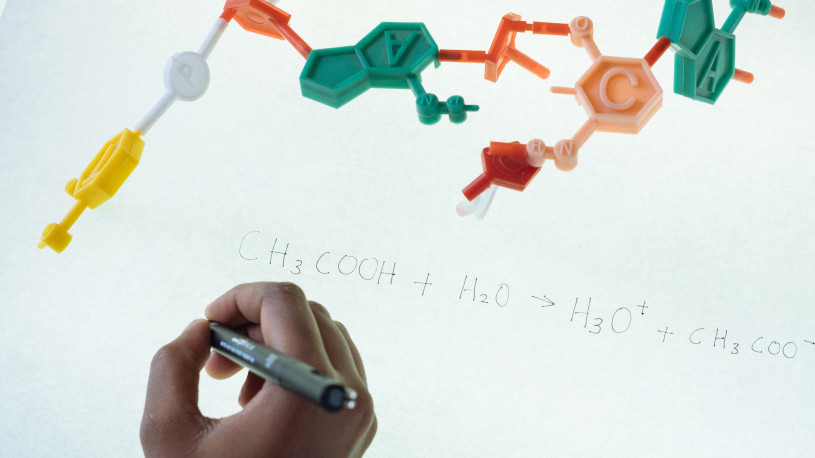

Continue ReadingSolvents are a vital part of the manufacturing and chemical industry, as they often make up the bulk of a chemical product, and dramatically affect how it works. For example, solvents influence how pesticides stay longer on leaves, how paints and inks dry faster, and how cosmetics are applied more easily.

One of the biggest challenges facing solvent manufacturers when developing new chemical products is predicting the solubility of small molecules in different solvents. But this task is about to become a lot easier as research chemists have created a ‘practical toolbox’ to aid solvent developers and chemical raw material suppliers in predicting how molecules will react in solvents.

Up until now, solubility has been predicted using the, so-called, Hansen Solubility Parameters: dispersion (D), polar interactions (P), and hydrogen bonding (H). Currently, this is used to great effect in the coatings and polymers industry for predicting the solubility of polymers.

However, the parameters have two major limitations that prevent them being used effectively in other industries, such as pharmaceuticals and cosmetics:

1. Drugs and cosmetics typically have more varied functional groups.

2. The original Hansen parameters exclude thermodynamic considerations regarding mixing, melting and dissolution. This is acceptable for polymers (where the thermodynamics cancel out) but not for small molecules.Working with a team based at Solvay (headed by Dr Bernard Roux), Dr Manuel Louwerse and Prof. Gadi Rothenberg, have now improved Hansen’s model and adapted it to handle small-molecule solutes by including the thermodynamics of mixing, melting and dissolution.

As the online scientific journal Phys.org explains, “The improvements are based on a better description of both the entropy and the enthalpy terms. When a compound dissolves, molecules leave the crystal and mix into the solvent. This increases the entropy, but usually costs some enthalpy. The key issue here is that the amount of entropy gained by mixing determines how much enthalpy can be lost while keeping a negative ∆G (in other words, maintaining the driving force for the dissolution). Since the entropy effect depends on the concentration, the temperature, and the size of the molecules, these should all be included.”

The research team have now published their results in the journal ChemPhysChem, where they write, “The most important corrections include accounting for the solvent molecules’ size, the destruction of the solid’s crystal structure, and the specificity of hydrogen bonding interactions, as well as opportunities to predict the solubility at extrapolated temperatures.” Adding that, so far, “Testing the original and the improved methods on a large industrial dataset including solvent blends, fit qualities improved from 0.89 to 0.97 and the percentage of correct predictions rose from 54% to 78%.”

This is a significant improvement, as simply guessing the solubility of blends would give 50% correct predictions. The new model also enables predictions at extrapolated temperatures.

Furthermore, the research team has made access to the models and a full description of the theory publicly accessible, with the ‘full and annotated Matlab routines’ available. This has allowed other researchers to begin making adjustments to the HSPiP software.

The decision to share the ‘toolbox’ with everyone is based on a desire to bring academics and industry closer together. As Prof. Rothenberg notes, “Industrial partners need to keep their data confidential, but most of them realise that open-access publishing of the methods and tools creates goodwill and enables further developments by both collaborators and competitors. By sharing methods and tools, companies can benefit from each other’s knowledge without sacrificing data.”

How far this ‘goodwill’ goes in the business world is uncertain, but what is clear is that the ‘toolbox’ for predicting small molecule solubility in solvents will shorten the time and lower the cost for developing improved chemical products. By sharing the information, the researchers are helping the entire chemical industry.