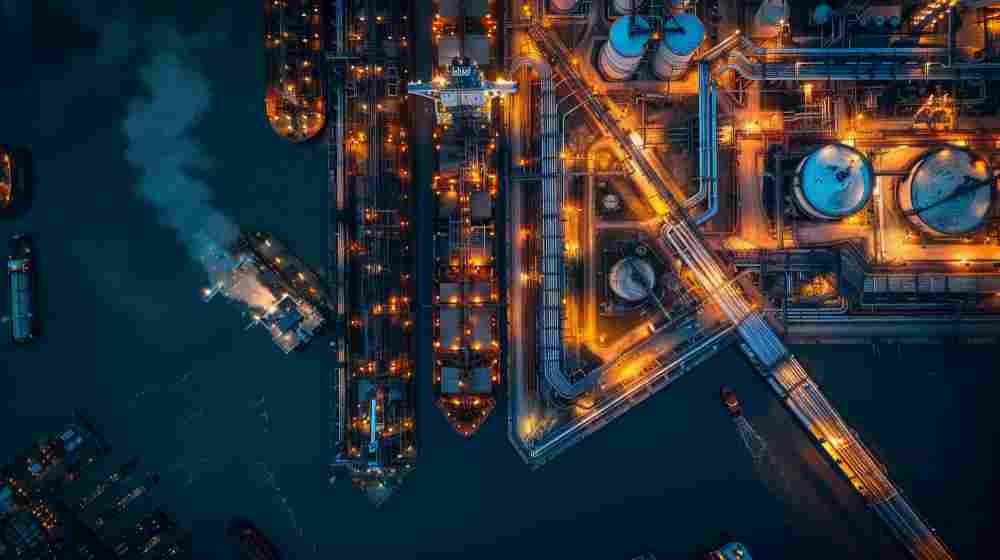

How Chemical Markets are Now Pricing Risk

In a world of ongoing war in Ukraine, conflict in the Middle East, and further tariff uncertainty, how can industrial chemical suppliers put a value on anything?

In a world of ongoing war in Ukraine, conflict in the Middle East, and further tariff uncertainty, how can industrial chemical suppliers put a value on anything?

From pricing to procurement, see how other B2B sectors are reshaping raw material trade and distribution.

The options available for raw material suppliers hoping to make headway for sustainable construction feedstocks.

How raw material buyers and sellers are protecting themselves against the real cost of supply chain disruption.

How high energy costs are squeezing Europe’s chemical industry, and where industry plans and Brussels' policy align — and clash.

How chemical industry start-ups are exploiting the economic advantages of electrification.

Who will benefit most from the new trade deal between India and the EU?

The UK CBAM represents a significant shift in the regulatory and trading landscape for chemicals.

How far will changes to America’s chemical industry regulation go?

How will chemical and raw material sourcing be impacted now that tighter EU environmental rules have been enforced?

The 4 biggest raw material sourcing risks and how chemical buyers can stay competitive.

How the power of information can result in chemical industry profit.

Industrial Chemicals

How raw material prices, manufacturing trends, global politics, and regional policy will impact the same industry differently on both sides of the pond.

Industrial Chemicals

How shopping for Christmas presents and sourcing industrial feedstocks and chemicals is actually the same challenge.

Chemical Trade

Why industrial chemical traders should expect a reshaped, not a vanishing “forever chemicals” market.

Chemical Trade

As the cost–benefit equation shifts, can there still be value in producing and trading “forever chemicals”?

Industrial Chemicals

Will new safety limits on cobalt processing further undermine Europe’s chemical industry?

Industrial Chemicals

What impact will the new EU-Australian deal have on the chemical industry?

Chemical Trade

How rare earths can now be extracted with viruses.

Industrial Chemicals

From regulation to revenue: the business case for sustainable trading.

Chemical Trade

Practical ways for chemical traders to turn eco-friendly into a deal maker.

Chemical Trade

Discover how digital chemical platforms are transforming the sourcing of industrial chemicals and feedstocks.

Industrial Chemicals

How adaptability, not scale, is determining success in sodium tripolyphosphate trading.

Chemical Trade

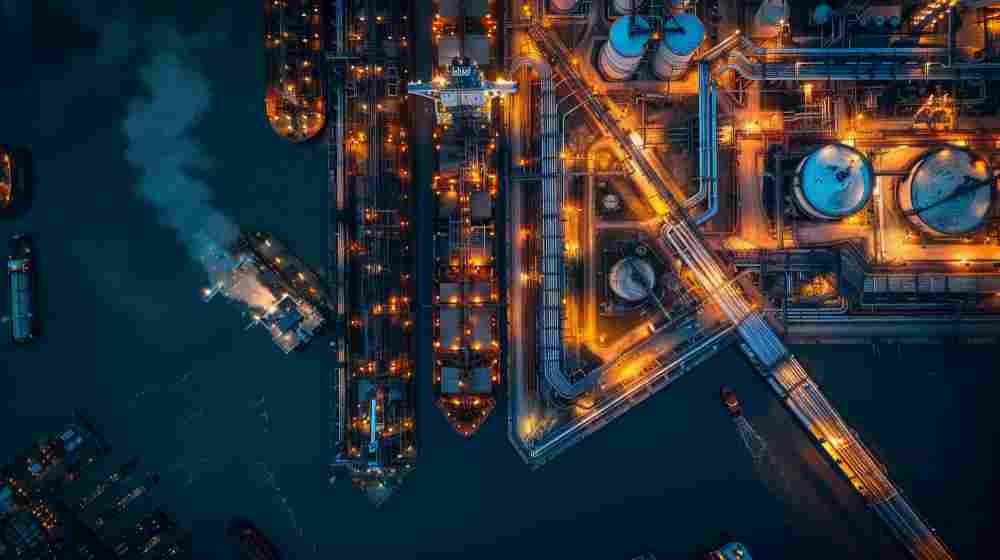

From backwater importer to petrochemical behemoth: how China’s chemical industry now rules global chemical trade.