STPP Market Moves and Price Pressures

How adaptability, not scale, is determining success in sodium tripolyphosphate trading.

Sodium tripolyphosphate (STPP) may not make headlines often, but its use as a feedstock for detergents, ceramics, water treatment, and food processing makes it a vital building block of modern industry. This makes it all the more curious as to why chemical traders have begun to sense something different in the STPP market, as it shows signs of both strain and opportunity.

With prices climbing, regional growth diverging, and environmental compliance stiffening, trade flows for this important raw material are reshaping, challenging both manufacturers and chemical SMEs to adapt quickly.

The shift in STPP markets began in April 2025, when Russian STPP prices rose sharply, reflecting a global cost squeeze. As a surge in phosphoric acid and sodium carbonate prices — two key feedstocks — inflated production costs while strong downstream demand from India and Europe also kept prices firm.

For chemical traders and procurement teams, this volatility presented a double-edged sword. Rising input prices were narrowing manufacturer margins to a point of threatening supply disruptions. Yet for those positioned early, these same swings created trading opportunities, where secured contract volumes from earlier in the year left some well-positioned for profit.

Yet the situation was far from static, with a summer report on the global STPP market predicting a moderate growth path, expanding at roughly 4–5 per cent annually and projected to reach about $4 billion by 2035.

The growth predictions, however, were far from evenly distributed, with analysts foreseeing the Asia-Pacific region as becoming a dominant force in the STPP market, driven by robust detergent and ceramic manufacturing in China and India.

Europe, by contrast, faces structural headwinds, where environmental regulation, particularly restrictions on phosphate use in detergents and water discharge limits, is curbing local consumption. For this reason, imports have weakened, and many producers are reconsidering capacity investments.

For European SMEs, this shifting geography need not spell decline. Instead, it highlights where value is moving from bulk commodity STPP to specialised, higher-margin grades. Food-grade, ceramic, and water-treatment applications remain strong, especially where consistent quality and compliance are more valuable than scale. This means that chemical traders who are able to pivot into these niche markets — or to act as intermediaries between Asian suppliers and European buyers — can still find healthy returns.

Yet beyond prices and volumes in the short and medium terms, a quieter revolution is under way which will have enormous ramifications on the distant outlook for STPP markets, as sustainability has become the decisive factor in STPP’s future as a chemical feedstock.

With phosphate regulations tightening across the EU and REACH requirements becoming more demanding, buyers increasingly expect documentation on environmental performance and source traceability.

Related articles: The Day the Chemical Industry Map Was Redrawn or Agentic AI: A Chemical Industry Revolution Already Underway

In response, STPP manufacturers have created cleaner production routes, improved waste management, and are utilising more energy-efficient processes. But these improvements have raised costs — and may push smaller, non-compliant producers out of the market. For traders, this means two things:

· Vet suppliers carefully to ensure environmental compliance, and

· Use sustainability credentials as a selling point when marketing to European buyers.

Interestingly, sustainability pressures may also lead to supply tightness, as non-compliant plants close. In such scenarios, compliant chemical traders with secured supply lines stand to benefit from stronger pricing.

The Strategic Outlook for European Chemical Traders

Three trends define the current STPP landscape:

1. Upstream cost inflation, which increases volatility but also trading opportunities.

2. Uneven global growth, with Asia leading and Europe restructuring.

3. Rising sustainability standards, reshaping competitive advantage.

To remain profitable, European SMEs should therefore focus on four key strategies:

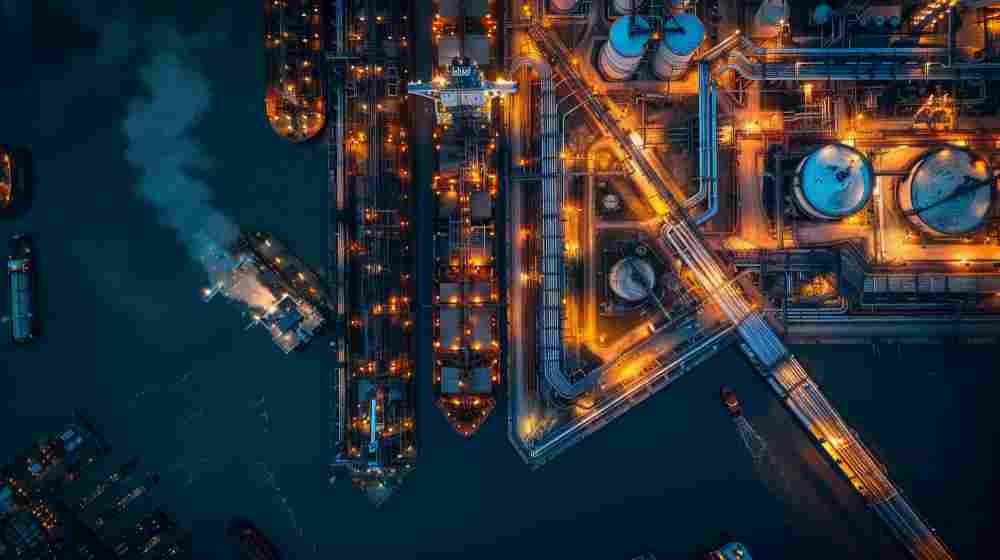

1. Diversify sourcing — especially towards Asia, MENA, or Eastern Europe.

2. Lock in supply contracts early during cost-up cycles.

3. Specialise in higher-grade or niche STPP markets where competition is thinner.

4. Track environmental compliance as closely as price movements.

Despite rising costs and regulatory pressure, STPP remains an essential industrial chemical with resilient demand. For manufacturers dependent on supplies of STPP, opportunities lie in agility, where anticipating cost cycles, securing compliant suppliers, and targeting specialised segments is likely to reduce input costs more effectively than simple discounts from bulk buying.

The message is clear: those who follow the signals of sustainability, regulation, and regional divergence — rather than following a price chart — may find a competitive edge in this evolving phosphate market. Adaptability, not scale, it seems, will determine success in the next phase of STPP trade.