The Day the Chemical Industry Map Was Redrawn

From backwater importer to petrochemical behemoth: how China’s chemical industry now rules global chemical trade.

Historians will look back on September 12th, 2025, as a pivotal moment in the industry. It was a red-letter day marking the point when China’s chemical industry truly announced itself as Sinopec's rose to the top of the ICIS Top 100 Chemical Companies list.

It also signalled the end of Europe's long-standing dominance in basic chemicals. For not only does Sinopec now top the list, surpassing Germany’s BASF, but China also holds three other top ten entries in PetroChina, Rongsheng Petrochemical, and Wanhua Chemical (at 5th, 9th, and 10th respectively)—further marking the moment as a fundamental realignment of the global chemical landscape.

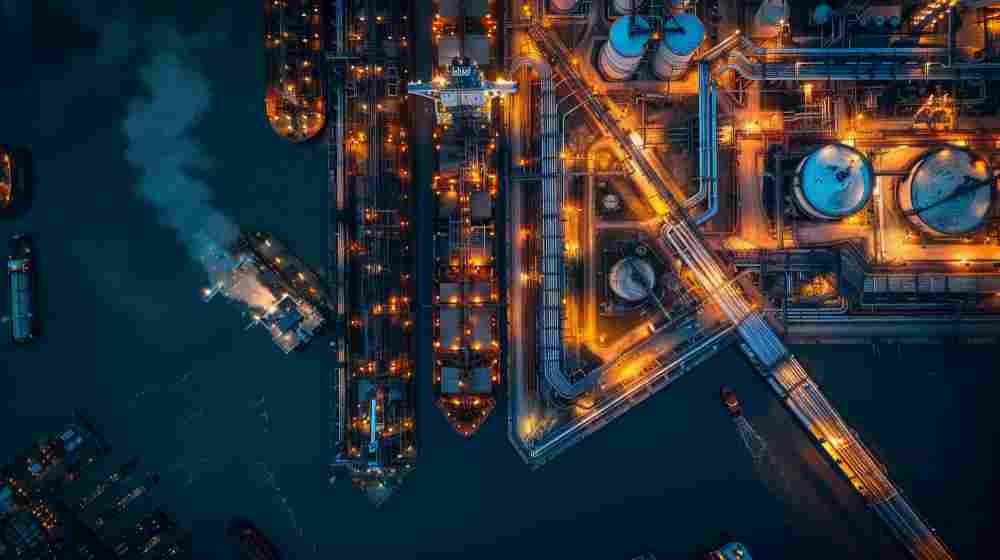

China's ascent in the petrochemical sector is the result of deliberate government policy and strategic investment. For years, state-owned enterprises, like Sinopec, have benefited from Beijing’s financial and regulative support alongside coordination with the manufacturing sector, enabling them to build large, integrated refining and petrochemical complexes. These facilities not only meet domestic demand but are also positioned to serve global markets, at extremely competitive prices.

Related articles: The Four Forces Shaking Europe’s Chemical Industry or Europe’s Plastics Recycling Industry Faces Crisis

In contrast, Europe's chemical industry faces significant challenges. High energy costs, stringent environmental regulations, and ageing infrastructure have eroded the competitiveness of European chemical producers. Many are struggling to maintain profitability, and many more have shuttered or are considering closure or divestiture.

“Chemical producers in Europe and other parts of Asia … have been impacted most severely and have already implemented a barrage of plant closures,” notes Phillip Broadwith, Chemistry World’s business editor. “Examples include crackers and refineries in the UK and Europe run by Dow, ExxonMobil, LyondellBasell, Sabic, TotalEnergies and Versalis.”

Oversupply and the Energy Transition

According to Lee Andrew Fagg, Vice President for Chemicals Consulting at Wood Mackenzie, the global chemical industry, “stands at a critical juncture as it experiences one of its most challenging periods in recent history.”

He also notes how China’s success story is so disruptive that even the largest chemical producers are having to grapple with the basic economics of oversupply and the pressures of the energy transition. These factors are particularly challenging for regions like Europe, where high operational costs and regulatory burdens make it difficult for producers to remain competitive.

The oversupply crisis is exacerbated by China's aggressive expansion in petrochemical production. As Chinese chemical companies have ramped up output, they have flooded the market with competitively priced products, further suppressing margins for producers in other regions. Simultaneously, the global push towards sustainability is prompting a re-evaluation of traditional production methods, adding another layer of complexity to the chemical industry's original business model.

Implications for Traders and Manufacturers

For chemical traders and manufacturers in the chemical industry, these developments present both challenges and opportunities.

· Supply Chain Realignment: The shift in production from Europe to China necessitates adjustments in supply chains, with chemical traders needing to establish new sourcing strategies and logistics networks to accommodate.

· Cost Competitiveness: With Chinese chemical producers offering lower-priced products, European manufacturers must find ways to enhance efficiency and reduce costs to remain competitive.

· Sustainability Initiatives: The pressure to adopt sustainable practices is intensifying. Chemical companies that invest in green technologies and circular economy models may gain a competitive edge in the evolving market.

· Strategic Partnerships: Collaborations with Chinese firms or other international partners could provide access to new markets and technologies, facilitating growth and innovation.

The events of September 12th, 2025, represent more than a milestone in corporate rankings—they signify a historic turning point in the global chemical industry.

China’s rapid rise from a net feedstock importer to a dominant chemical exporter has redrawn the map of petrochemical power, challenging long-standing European supremacy and reshaping competitive dynamics worldwide. For chemical traders and manufacturers, this shift demands agility, foresight, and strategic adaptation, from rethinking supply chains to embracing sustainability and forging international partnerships.

Yet beyond immediate commercial implications, this moment marks a broader narrative: the global chemical landscape is entering a new era, one defined by scale, integration, and geopolitical influence. But does that leave room for European chemical production?

Photo credit: mrsiraphol, DC studio, kjpargeter, & freepik