The Four Forces Shaking Europe’s Chemical Industry

A look into the decline of Europe’s chemical industry advantage.

Europe’s chemicals and plastics industries are facing some of their toughest periods in decades.

Once the backbone of the continent’s industrial competitiveness, the sector now finds itself under mounting pressure from a four-pronged economic assault. This is leaving many chemical producers and traders not asking whether change is coming or not, but wondering if they can survive long enough to adapt.

The Perfect Storm: Four Forces Colliding

The term “perfect storm” has been widely used to describe the combination of challenges now confronting European plastics and chemical producers—and it is no exaggeration. Each of these forces would be difficult to manage on its own; together, they are reshaping the map of the European chemical industry.

The first and most obvious challenge is energy. Following years of volatility sparked by the war in Ukraine and the restructuring of gas supply chains, Europe’s industrial energy costs remain stubbornly higher than those of its global competitors. In a sector where feedstock and energy can represent up to 60 percent of total production costs, this imbalance is crippling.

Compounding this is the second challenge: weak demand. The slowdown in construction and automotive manufacturing has reduced the need for plastics, coatings, and engineered materials. The packaging industry, meanwhile, is shifting towards lighter and more recyclable alternatives, often with lower chemical input per unit. According to industry association Cefic, European chemical capacity utilisation has fallen to roughly 75 percent—levels not seen since the global financial crisis.

Third comes regulation. Europe has long prided itself on environmental leadership, but the pace and scale of recent legislation is testing even the most committed firms. Compliance with REACH, stricter emissions standards, and the upcoming phase-in of the Carbon Border Adjustment Mechanism (CBAM) all add cost and complexity.

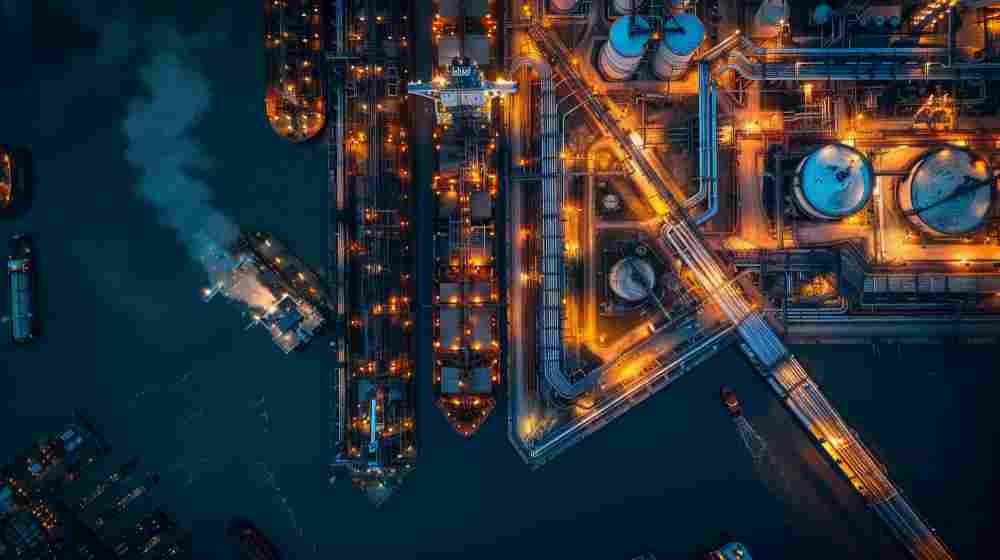

The fourth force is global competition. Producers in Asia, the Middle East, and the US continue to benefit from abundant feedstocks, lower labour costs, and increasingly sophisticated technology. New petrochemical hubs in Saudi Arabia and China are churning out polymers at a fraction of European costs. Meanwhile, US firms enjoy both cheap shale gas and access to a huge domestic market.

The impact of these pressures is already visible in a string of corporate announcements. Solvay has confirmed plans to shut down its inorganic compounds plant in Bad Wimpfen, Germany, by 2026, citing weak demand and untenable energy costs. Ineos has mothballed its chloromethane operations in France and paused propylene oxide production in Germany for similar reasons. Other chemical firms, including BASF and Covestro, are scaling back investment in Europe while expanding in the US and Asia, where energy and regulatory conditions are more favourable.

These closures are not isolated. They reflect a broader structural challenge where Europe’s cost base has diverged too far from what other regions are doing. Even specialty chemical producers, once protected by their focus on niche markets and technical know-how, are no longer immune. As today, even these higher-value segments are feeling the squeeze as customers find similar high-tech products from cheaper sources.

Implications for Chemical Producers

For chemical producers, the immediate task is survival through efficiency. Margin compression has become the new normal, pushing firms to scrutinise every aspect of energy use, logistics, and procurement. Electrification of processes, waste-heat recovery, and integration with renewable energy sources are all being explored.

Innovation remains essential but increasingly difficult to fund as chemical companies face a dilemma: decarbonisation demands new technologies and materials, yet low profitability limits their ability to invest. The challenge, then, is to innovate not just in chemistry, but in business models—through partnerships, shared infrastructure, and regional alliances.

Downstream Impacts on Chemical Traders

The crisis within Europe’s plastics and chemical production is also reverberating through the supply chain as manufacturers have begun diversifying their sourcing to non-European suppliers, while others are accelerating recycling and circular-economy initiatives to secure alternative raw materials.

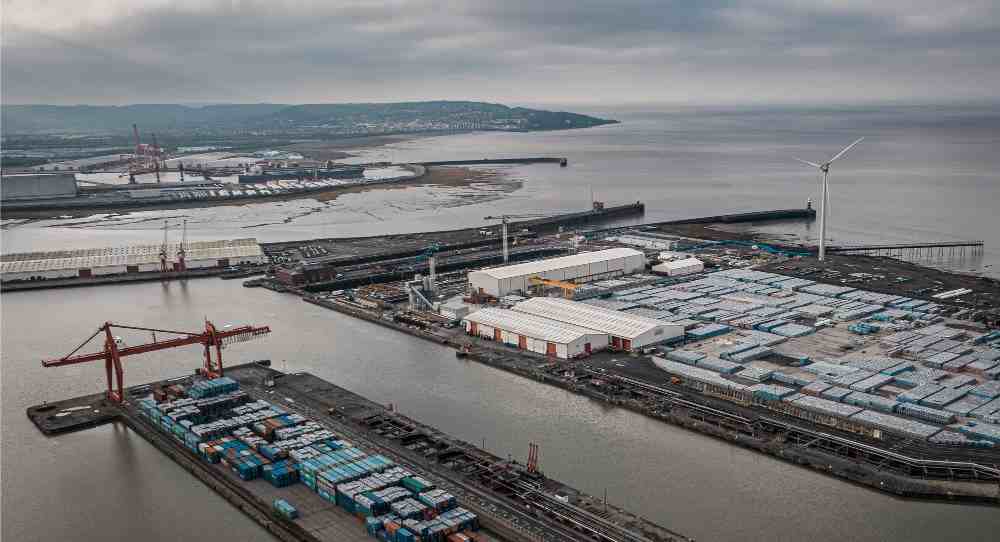

At the macro level, these shifts may permanently alter trade patterns. Imports of base chemicals and polymers into Europe are rising, while exports of high-value materials are stagnating.

The outlook for Europe’s plastics and specialty chemical industries remains highly uncertain. Energy prices could rise again if geopolitical tensions persist, while the global economic recovery is uneven and fragile. Regulatory tightening is likely to continue, even if policymakers introduce limited relief measures. Technological solutions — such as electrified processes or chemical recycling — offer hope, but scaling them will take time and significant capital.

Related articles: Agentic AI: A Chemical Industry Revolution Already Underway or Europe’s Plastics Recycling Industry Faces Crisis

The key question is whether Europe can retain enough chemical industry capacity to sustain its innovation ecosystem. If more plants close or relocate, the region risks losing not only production but also research, skills, and investment. For now, the “perfect storm” continues to gather force — and only those chemical companies agile enough to adapt to a new industrial reality will emerge intact.

Without them, Europe’s progress towards a circular economy will fail. For as Stephanie Kalil, Dow’s commercial vice president of packaging and specialty plastics for Europe notes, “Plastics are vital to decarbonization and a circular transition.” Warning that, “Without the physical assets and the industrial sector in Europe, we cannot establish the transition [and] once those assets are shut down, they're not coming back.”