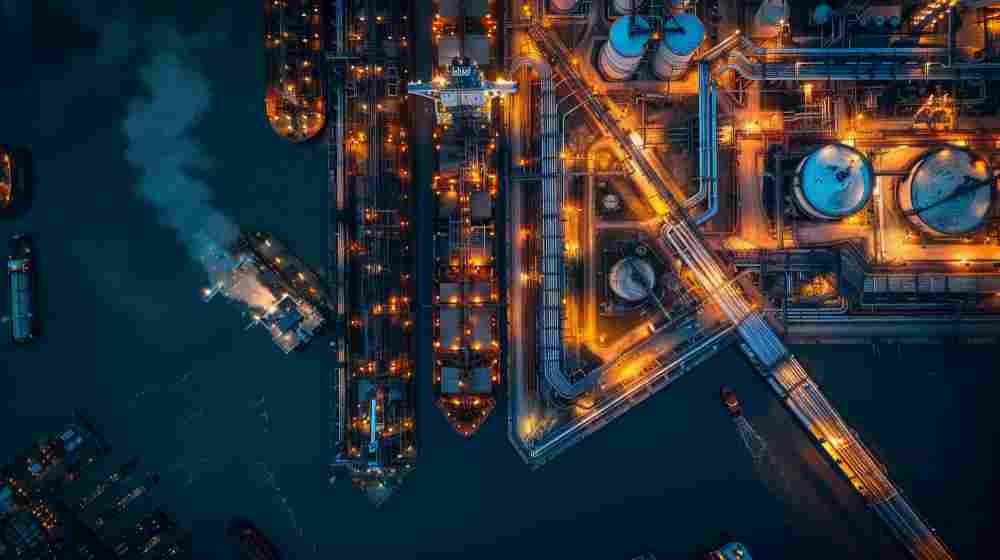

Turning Chemical Market Data into Competitive Advantage

How the power of information can result in chemical industry profit.

In today’s chemical industry, price volatility is more than a problem—it can be an opportunity.

From energy cost fluctuations to regional production imbalances and sudden feedstock shortages, unforeseen issues can quickly erode margins if chemical companies make procurement or sales decisions based on outdated information. For chemical traders and industrial manufacturers, the ability to access accurate, timely, and comprehensive market data is increasingly the difference between profit and loss.

Why Transparent Chemical Market Data Matters

Chemical prices are influenced by a wide range of factors, with raw material costs, regional demand shifts, regulatory changes, and chemical facility outages all playing a role in shaping both spot and contract prices. In this environment, relying solely on anecdotal intelligence, ‘hunches’, supplier quotes, or price reports, exposes chemical sales teams and procurement departments to unnecessary risk. Market data—when structured, verified, and continuously updated—enables decision-makers to benchmark prices, negotiate contracts confidently, and anticipate market swings.

Yet more than simply tracking current chemical prices, comprehensive chemical market intelligence provides context as it reveals trends, highlights potential opportunities, and helps forecasting for both chemical suppliers and producers. Improved chemical market insight also helps manufacturers benefit from improved budgeting and cost control through smart sourcing.

Applying Chemical Market Data to Real-World Decisions

But alongside using market data to formulate plans, chemical industry professionals are now able to leverage information across multiple areas. Chemical traders, for example, can compare regional prices to identify profitable supply routes or negotiate contracts backed by independent benchmarks. Procurement teams use historical and current price information to plan purchases around cyclical peaks, reducing exposure to price hikes, while manufacturers can analyse cost curves to determine whether it is more economical to produce in-house or source externally, optimizing both margins and capacity.

Typical applications of market data include:

· Negotiating supplier contracts with validated pricing.

· Spotting arbitrage opportunities across regions or product grades.

· Managing exposure to feedstock and energy cost swings.

· Supporting internal pricing models for sales and customer quotes.

Reliable data also strengthens forecasting and scenario planning, as they assist in understanding patterns in price volatility and help model multiple supply chain scenarios. In volatile chemical markets, this foresight is not just an operational advantage—it can be the difference between remaining in business or losing out to better-informed rivals.

Online Trading Platforms and Tools

Sourcing accurate chemical market data can be as hard as sourcing the raw materials themselves, but digital platforms can assist in the compiling and analysis of chemical market data and are increasingly being used to form industrial trading strategies. Not only do they provide real-time price updates, historical comparisons, and region-specific intelligence, but they can also make recommendations on how to transform raw information into action. For companies managing multiple products, markets, or geographies, these tools also streamline decision-making and improve responsiveness to market changes.

Related articles: Europe vs America: Diverging Paths for Plastics in 2026 or Is this the End of PFAS Production and Trade?

Access to quality market data ultimately converts information into a real competitive asset, so that chemical traders can negotiate better margins, manufacturers can optimize raw material sourcing, and all stakeholders can gain a clearer picture of what is happening in the market.

Looking ahead, as the chemical industry continues to develop with ever more information assisted by AI, those who leverage robust, independent chemical market data may be the only ones who are able to survive.

To learn more about chemical markets, chemical product prices, and raw material sourcing, visit SPOTCHEMI, the trading hub for chemical industry professionals.

Photo credit: Freepik, Pressfoto, & Dragen Zigic